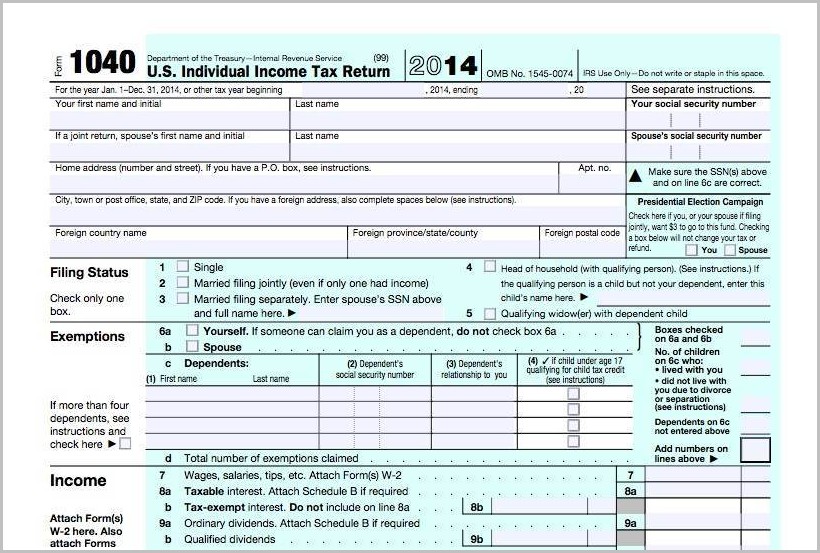

Irs 1040 Form | Tax day was first introduced in 1913, when the sixteenth amendment was ratified. Try the suggestions below or type a new query above. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day. We did not find results for: In the united states, tax day is the day on which individual income tax returns are due to be submitted to the federal government.

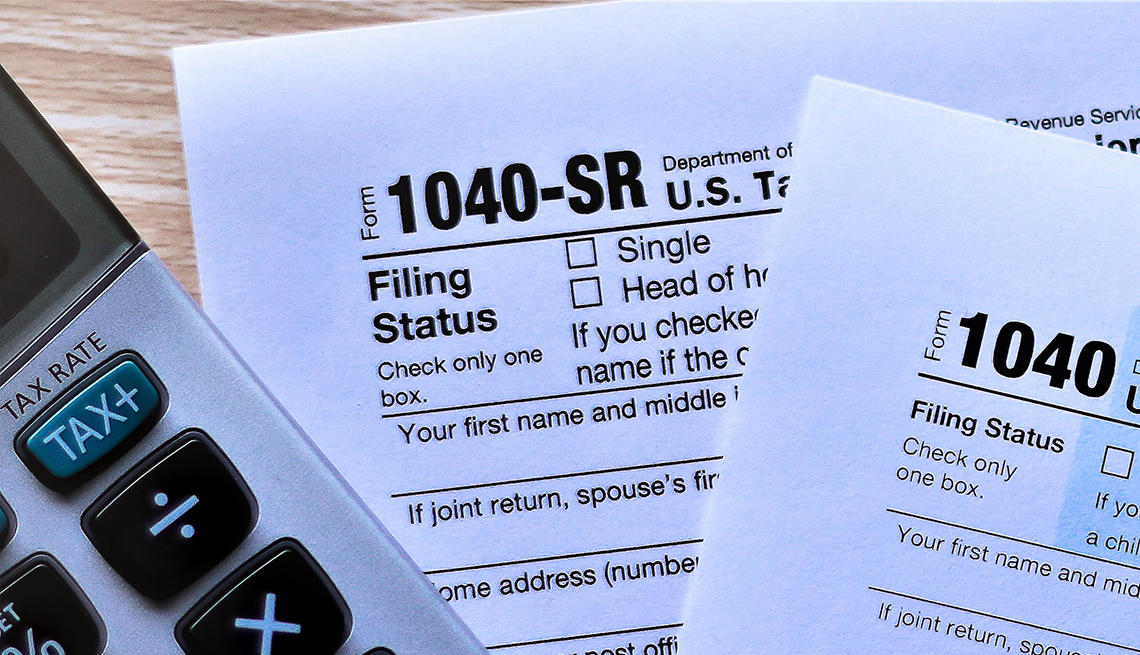

Try the suggestions below or type a new query above. We did not find results for: Since 1955, tax day has typically fallen on or just after april 15. Tax day was first introduced in 1913, when the sixteenth amendment was ratified. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day.

Tax day was first introduced in 1913, when the sixteenth amendment was ratified. In the united states, tax day is the day on which individual income tax returns are due to be submitted to the federal government. Try the suggestions below or type a new query above. Since 1955, tax day has typically fallen on or just after april 15. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day. We did not find results for:

In the united states, tax day is the day on which individual income tax returns are due to be submitted to the federal government. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day. Try the suggestions below or type a new query above. Since 1955, tax day has typically fallen on or just after april 15. Tax day was first introduced in 1913, when the sixteenth amendment was ratified.

Since 1955, tax day has typically fallen on or just after april 15. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day. Tax day was first introduced in 1913, when the sixteenth amendment was ratified. Try the suggestions below or type a new query above. We did not find results for: In the united states, tax day is the day on which individual income tax returns are due to be submitted to the federal government.

We did not find results for: Try the suggestions below or type a new query above. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day. Since 1955, tax day has typically fallen on or just after april 15. Tax day was first introduced in 1913, when the sixteenth amendment was ratified.

In the united states, tax day is the day on which individual income tax returns are due to be submitted to the federal government. The date is delayed if it conflicts with a weekend or public holiday such as emancipation day. Since 1955, tax day has typically fallen on or just after april 15. Tax day was first introduced in 1913, when the sixteenth amendment was ratified. We did not find results for: Try the suggestions below or type a new query above.

Irs 1040 Form: Tax day was first introduced in 1913, when the sixteenth amendment was ratified.